sales tax on leased cars in maryland

To calculate the trade-in tax credit in Maryland you can get the idea from the percentage of trade-in tax credit against your new cars purchase. In state of Maryland.

New Home Construction Contract Template Elegant New Residential Construction Proposal Templ Contract Template Rental Agreement Templates Business Plan Template

Charging full 6 sales tax up front on leased cars not based on the monthly payment 2.

. If you improperly paid Marylands 6 percent sales and use tax on a retail product or service that is normally not taxable in Maryland you should first try to seek a refund from the merchant. Used car listings in Maryland include photos videos mileage and features. 3 cents if the taxable price is.

Please provide a credible reference to confirm this if possible. Charging 6 tax AGAIN on the same car if you decide to buy it at lease end. Maryland collects a 6 state excise tax on the purchase of all vehicles.

If a leasing company purchases a vehicle through an out-of-state dealer however the company may have to submit the titling documents personally. 2019 Previous Generations. Like with any purchase the rules on when and how much sales tax youll pay.

1 cent on each sale where the taxable price is 20 cents. The most common method is to tax monthly lease payments at the local sales tax rate. The fee for titling a vehicle typically includes a title fee excise tax and a security interest lien filing fee if required.

Sales tax is a part of buying and leasing cars in states that charge it. Is the 6 sales tax due upfront on the sale price of the lease car or the lesee pays 6 tax on each payment. I doubt Maryland would remit any of the tax unless the original lessee was trading the car in on another new car in Maryland and then they may get a trade-in credit assuming Maryland does this.

Titling Vehicle Purchased by a Leasing Company. Some lease buyout transactions may be excise tax exempt. Maryland collects a 6 state excise tax on the purchase of all vehicles.

In Maryland does the dealer charge sales tax on the entire price of the vehicle when leased same as if it was purchased. Every used car we sell in Maryland comes with our no-haggle pricing. This means you only pay tax on the part of the car you lease not the entire value of the car.

Search our inventory of used cars for sale in Maryland at Enterprise Car Sales. When paying for the vehicle youll also be charged a 375 percent document fee based on the vehicles overall cost. So if you assume that lease none of that payment represents sales tax.

In most cases a Maryland dealer handles the titling process as well as the lease agreement and the delivery of the vehicle to the lessee. Back to Maryland Sales Tax Handbook Top. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

Fast Easy Tax Solutions. E82 E83 E87 E88 Model Year. However leases for at least one year are considered to be exempt.

Arkansas Illinois Maryland Oklahoma Texas and Virginia calculate sales tax on the full price of the vehicle with the payment due at signing. See Fees for Registration Plates for more information. Multiply the total taxable cost by 006 as the tax rate for Maryland is six percent.

This page covers the most important aspects of Marylands sales tax with respects to vehicle purchases. 2 cents if the taxable price is at least 21 cents but less than 34 cents. I am considering leasing a vehicle instead of buying it for the 1st time.

Used Cars for Sale in Maryland. However some states calculate the sales tax differently. Sales tax on leased cars in maryland.

This would be the payment with sales taxes included meaning that 4413 per month was sales tax for this particular payment. However leases for at least one year are considered to be exempt. In the state of Maryland any leases for a maximum of 180 days will be taxed at a special rate.

Maryland sales tax on leased cars - WTF. F20 F21 Model Year. If you are unable to obtain a refund from the merchant you may apply for a refund by completing Form ST 205 - Sales and Use Tax Refund Application.

The amount you get after that calculation is what you can expect to pay in taxes for the car on top of the purchase price. Ad Find Out Sales Tax Rates For Free. The fee for registration varies by the type of vehicle its weight andor its intended use.

The potential saving costs for 288 trade-in worth 5000. Effective January 3 2008 the Maryland sales and use tax rate is 6 percent as follows. How is sales tax calculated on a car lease in Maryland.

For example the combined taxes imposed for leasing a 15000 car and then buying it after two years were 1521 in Maryland. The price you see is. In contrast taxes were 450 in Virginia.

And I am being told that for Maryland I have to pay the whole car price in tax IE 22000 price after negotiations x 6 1320. With a 24 month lease that increases the monthly by 55. Sales tax on Maryland leased vehicle.

Sales of tangible media property are subject to sales tax in Maryland. For vehicles that are being rented or leased see see taxation of leases and rentals. If your car or truck is.

Or is the sales tax only on the lease payment portion. Sales of motor vehicles are subject to the maryland motor vehicle titling tax which is administered by the maryland motor vehicle administration. They dont remit any portion of that to Maryland to cover sales taxes as those taxes have already been paid.

On average 575 applies as a car trade-in services in Maryland while purchasing a new car according to new rules and regulations. For example if the monthly lease payment is 300 and the sales tax is 8 percent the total payment is 324.

Proposed Riverfront Stadium Gets A Name National Car Rental Field National Car Riverfront Nfl Stadiums

Nj Car Sales Tax Everything You Need To Know

Sales Tax On Cars And Vehicles In Maryland

How To Cash In On The High Value Of Your Leased Car Forbes Wheels

Nj Car Sales Tax Everything You Need To Know

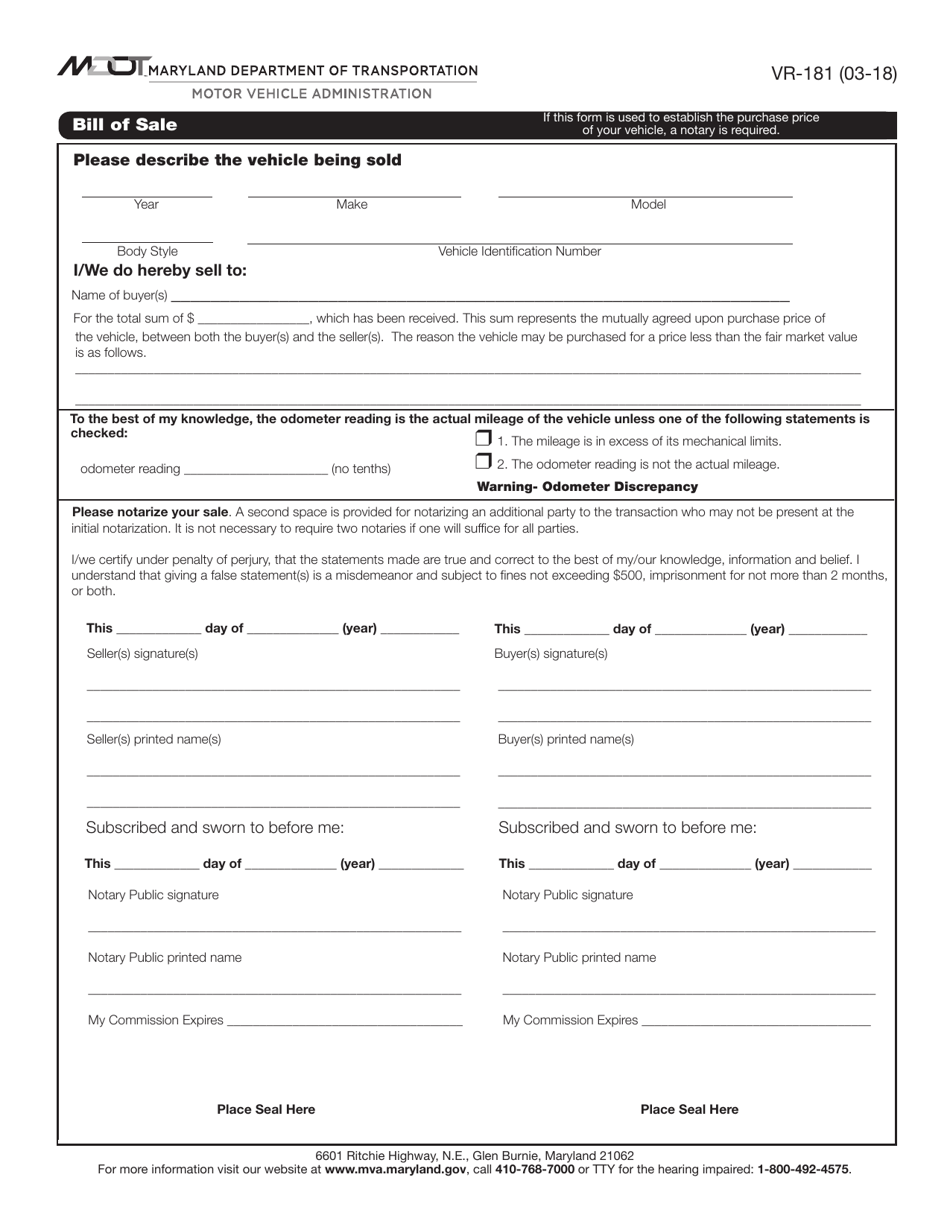

Form Vr 181 Download Fillable Pdf Or Fill Online Vehicle Bill Of Sale Maryland Templateroller

Bike Rental Contract Template Doc Sample Contract Template Certificate Of Participation Template Certificate Of Achievement Template

2012 Ford F 550 Tiffany Coach Bus 28 Pax Limousine Party Bus For Sale Party Bus For Sale Party Bus Buses For Sale

Car Donations For Cash Car Donate Bmw Car

What S The Car Sales Tax In Each State Find The Best Car Price

A Z Of Maryland Car Tax In 2021 Calculate Tax Bumbleauto

A Z Of Maryland Car Tax In 2021 Calculate Tax Bumbleauto

Register Your Car In Maryland Step By Step Guide Bumbleauto

Zurich Car Insurance Quote Malaysia 2021 Insurance Quotes Car Insurance Auto Insurance Quotes

Maryland Car Tax Everything You Need To Know

How To Donate A Car In New York Donate Car Car Rental Company Car Lover

A Z Of Maryland Car Tax In 2021 Calculate Tax Bumbleauto

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Maryland Tax Credits Southern